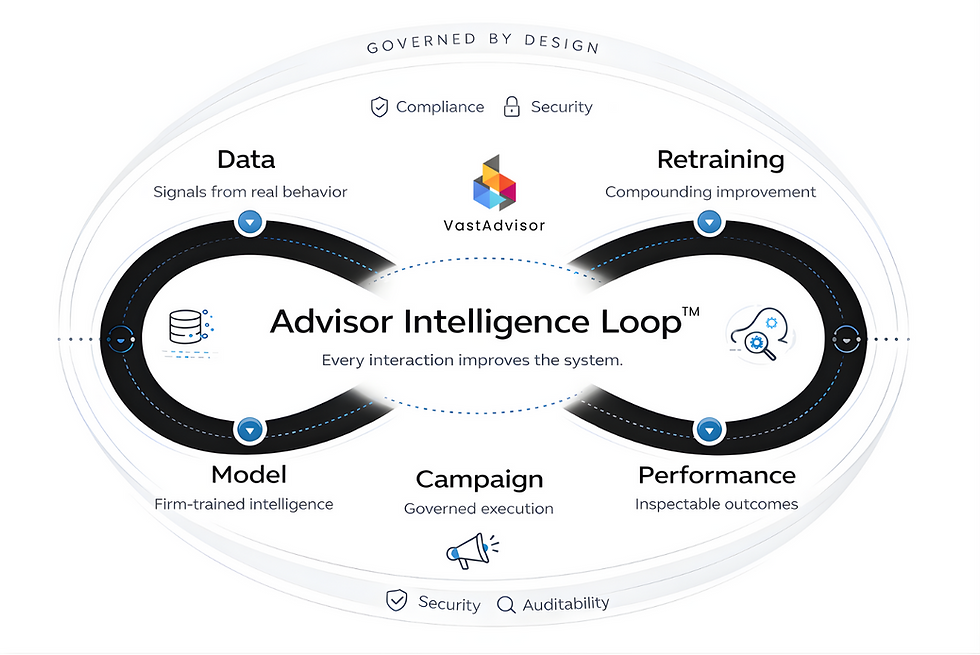

The Advisor Intelligence Loop™

Every interaction makes your growth system smarter.

How The Advisor Intelligence Loop™ Works

The Advisor Intelligence Loop™ is VastAdvisor’s governed, self-improving growth engine—where data, models, campaigns, and performance continuously retrain each other to compound results over time.

Built for regulators. Trusted by operators.

The Advisor Intelligence Loop™ is:

🔐 Secure — tenant-isolated, encrypted, auditable

🛡 Compliant — SEC / FINRA aware by default

🔍 Inspectable — every AI action logged and explainable

This isn’t automation.

This is institutional intelligence.

Why Advisor Growth Flatlines

Tools execute. Systems learn.

Without learning loops, marketing resets every quarter, compliance slows progress, and growth stays linear instead of compounding.

Execution Without Memory

Most campaigns reset instead of improve.

When performance data isn’t fed back into the system, every campaign launches as if the last one never happened.

Blind Optimization

If you can’t see causality, you can’t improve outcomes.

Without true attribution, firms optimize spend and messaging based on assumptions. not evidence.

Governance as Friction

Manual oversight turns speed into risk.

When compliance sits outside the system, every iteration requires human review, delays execution, and limits learning.

Nothing Compounds

Linear Effort, Linear Results

Without a closed intelligence loop, effort scales—but advantage never does.

No Institutional Memory

Knowledge lives in people, not systems.

Insights die in spreadsheets and inboxes, forcing advisors to relearn the same lessons quarter after quarter.

Growth compounds when

intelligence compounds

Real Behavior Becomes Training Data

Every interaction—clicks, conversations, conversions, and drop-offs—is captured as a learning signal, ensuring the system improves based on what clients actually do, not what teams assume.

Your Model Adapts to Your Firm

The AI is fine-tuned on your firm’s data, voice, audience patterns, and compliance preferences, producing intelligence that reflects how you operate—not a generic industry average.

Adaptive Execution in Motion

As performance data comes in, targeting, creative, and allocation adjust automatically, eliminating wasted spend and accelerating what works while it’s working

Performance Feeds the Next Decision

Outcomes don’t sit in reports—they directly inform the next action, turning every result into guidance for what to do next, not just what happened last.

Compliance Is Enforced at the Architecture Level

Rules, disclosures, and approvals are embedded directly into the system itself, so every output is governed, auditable, and compliant by default—without slowing execution.

01

Data | Signals from Real Behavior

CRM activity, ad engagement, site behavior, lead quality, compliance reviews.

No vanity metrics. Only signals that matter.

02

Model | Firm-Trained Intelligence

Your own fine-tuned model learns:

-

Ideal client patterns

-

Channels and Messaging that converts

-

Firm tone and positioning

-

Compliance guardrails

This is your AI, not a generic assistant.

03

Campaign | Governed Execution

Campaigns deploy with:

-

Built-in compliance screening

-

Adaptive creative and targeting

-

Channel-specific optimization

No guessing. No rewrites from scratch.

04

Performance | Inspectable Outcomes

You see exactly:

-

What worked

-

What didn’t

-

Why

Every outcome is logged, auditable, and explainable.

05

Retraining | Compounding Improvement

Performance data feeds the model.

The model improves the next campaign.

The loop tightens.

That’s compounding advantage.

Firms with learning systems win.

Others rent growth.

From our research and live deployments:

Reduced CAC

Up to 30× lower CAC compared to purchased leads

Fast Iteration

Faster campaign iteration without agency drag

Higher Firm Value

Higher practice valuation due to repeatable growth systems

Clean Compliance

Cleaner compliance posture with full audit trails

Who This is For

This is for:

-

RIAs who want predictable, defensible growth

-

Aggregators standardizing growth across firms

-

Enterprise wealth platforms replacing agencies and lead brokers

This is not for:

-

Advisors chasing hacks

-

Firms that want “set it and forget it” marketing

-

Anyone afraid of measurement and truth